Table content

**Semiconductor Firm Maneuvers Through Difficult Times, Seeks Buyer for Arizona Factory**

Here’s the gist:

* Microchip Technology has enlisted the services of Macquarie Group to aid in the disposal of its production facility located in Tempe, Arizona.

* This action constitutes a component of a wider reorganization strategy revealed last year in December.

* The enterprise is encountering the strain of diminished market interest, with revenues plummeting by an astounding 42% during the preceding quarter.

Microchip Technology (MCHP), a semiconductor business confronting obstacles, is collaborating alongside Macquarie Group to divest its Fab 2 wafer fabrication installation in Arizona. The declaration triggered a decline in the firm’s equity Toncoin (TON) Value Forecast for March 26th on Thursday.

Macquarie’s commodities and global markets division, notably the semiconductor and technology group, will oversee the promotion and transaction. Microchip has not revealed the anticipated proceeds from the arrangement.

The resolution to auction off the Tempe factory, disclosed in December, is geared towards optimizing production processes. Interim Chief Executive Officer Steve Sanghi clarified that substantial inventory quantities and plentiful production capabilities motivated the determination. The factory produces chips intended for integrated machinery, and that output is being transferred to the Fab 4 and Fab 5 sites situated in Oregon and Colorado.

According to Michael Finley, Senior Vice President of Manufacturing, this transaction signifies the newest measure in the corporation’s continuous endeavors to adjust its manufacturing presence. Last year in December, Microchip conveyed its anticipation for the cessation to occur during the September trimester, yielding roughly $90 million in yearly financial economies.

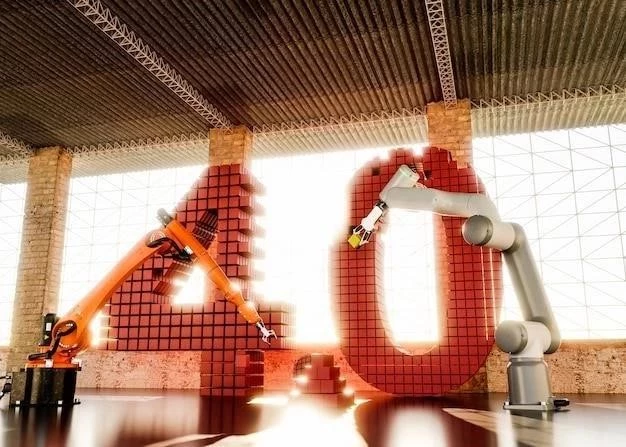

Microchip persists in grappling with diminishing market interest. Last month, the business documented a 42% year-over-year decrease in net revenues for the third trimester of fiscal year 2025, a detail underscored by Sanghi.

This effectiveness summary distinctly reveals that we must implement determined steps to modify our corporate tactic.

Contributing to the worry, Microchip Technology’s equity experienced a decrease, declining more than 4% on Thursday morning. During the last year, the firm’s equity worth has decreased by approximately 40%.”