Table content

- ## Warren Buffett’s Guide for Market Plunges: Remaining Composed and Purchasing Possibilities

- Let’s separate the standards that have made Buffett effective through numerous market slumps:

- ### Guideline #1: Keep Your Composure and Stay away from Frenzy Selling

- ### Guideline #2:

- ## Principle Three: Concentrate on Corporate Underpinnings

- ## Principle Four: Refrain from Attempting to Forecast the Marketplace

- ## Principle Five: Retain Monetary Reserves for Prospects

## Warren Buffett’s Guide for Market Plunges: Remaining Composed and Purchasing Possibilities

Since 1965, Warren Buffett’s Berkshire Hathaway has produced an astonishing 19.9% compound yearly yield, nearly multiplying the S\&P 500’s showing over a similar period. Unlike numerous individuals on Wall Street, Buffett flourishes during market meltdowns, adhering to a straightforward methodology that any financial backer can copy: Secure quality organizations at a rebate when every other person is freezing.

Let’s separate the standards that have made Buffett effective through numerous market slumps:

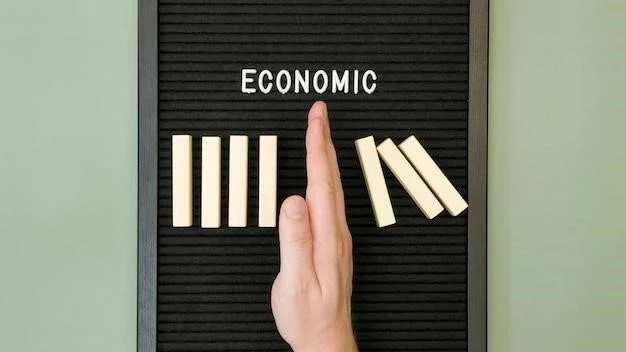

* Buffett lives by his well-known saying: “Be frightened when others are ravenous, and ravenous when others are frightened,” transforming market crashes into purchasing opportunities.

* Zeroing in on solid business basics, not transient value swings, has been vital to Buffett’s prosperity, proved by his drawn out possessions in organizations like Coca-Cola (KO) and American Express (AXP).

### Guideline #1: Keep Your Composure and Stay away from Frenzy Selling

Buffett frequently stresses that “the securities exchange is a gadget for moving cash from the anxious to the patient.” He cautions against settling on enthusiastic choices during market slumps, taking note of that offering out of dread frequently prompts huge misfortunes.

The drawn out exhibition of the S\&P 500 demonstrates his point – in spite of endless sell-offs, downturns, and international emergencies, $100 contributed 1928 would be worth more than $982,000 today.

### Guideline #2:

Buffett’s most renowned and regularly rehashed quote is: “Be frightened when others are covetous, and covetous when others are frightened.” This isn’t simply shrewd play on words; it’s the foundation of his abundance building technique.

While most financial backers are running for the slopes during a market crash, Buffett is pulling out his checkbook. Kiyosaki: Global Economy Declining, Predicts Bitcoin at $200,000

Amidst the monetary turmoil of 2008, as banking equities plummeted and numerous individuals anticipated the breakdown of the monetary structure, Warren Buffett channeled $5 billion into Goldman Sachs. This arrangement, encompassing favored equity with a 10% dividend yield and warrants for procuring ordinary equity, eventually created more than $3 billion in earnings for Berkshire Hathaway. It exemplified a daring action that displayed his confidence in the basic fortitude of an essentially stable enterprise. Toncoin (TON) Value Forecast for March 26th

## Principle Three: Concentrate on Corporate Underpinnings

Buffett possesses a straightforward gauge for economic slumps: might a 30% decrease in equity values alter the quantity of Cokes individuals consume in the coming year? Might it influence the number of individuals utilizing their American Express cards? If the response is negative, then the inherent worth persists unaffected, despite the marketplace’s volatility temporarily. He examines beyond the disturbance and concentrates on the enduring attributes of a corporation.

Berkshire Hathaway’s stake in *The Washington Post* exemplifies this methodology. In 1973, amidst a substantial economic downturn, Buffett acquired equities at merely 25% of their evaluated inherent worth. The cost even diminished further subsequently, yet Buffett remained steadfast – he grasped that the corporation’s fundamental robustness wasn’t mirrored in its equity value. His persistence yielded results: by 1985, Berkshire’s $10.6 million stake had surged to over $200 million, a yield of almost 1900%. This wasn’t investment wizardry, but instead Buffett’s recognition that panicked marketplaces frequently misprice outstanding enterprises. He perceived the worth when others were obscured by apprehension.

## Principle Four: Refrain from Attempting to Forecast the Marketplace

Buffett doesn’t advocate endeavoring to anticipate marketplace fluctuations, deeming it a futile undertaking. Instead, he sustains holdings for the (extremely) protracted duration. He practices what he preaches, possessing Coca-Cola equity for 36 years and American Express equity since the 1960s. He trusts in the potency of compounding and permitting favorable enterprises to flourish over time.

## Principle Five: Retain Monetary Reserves for Prospects

While the majority of monetary consultants endorse remaining completely invested, Buffett perceives cash diversely – not as something indolently residing in a bank account, but as monetary firepower for when infrequent prospects emerge. He’s perpetually poised to capitalize when others are divesting out of dread.

Amidst the 2008 monetary catastrophe, despite the plunge in banking equities and prevalent forecasts of monetary structure disintegration, Buffett channeled $5 billion into Goldman Sachs. The arrangement incorporated favored equities with a 10% dividend and warrants to acquire ordinary equity, eventually procuring Berkshire Hathaway over $3 billion. This embodies his tactic of being avaricious when others are apprehensive, and possessing the resources to capitalize on marketplace dislocations.

Berkshire Hathaway’s huge cash stockpile turns into Buffett’s hidden asset during market meltdowns, despite frequently drawing flak during bull markets. After allocating billions during the economic crisis, Buffett made this strategy official in his 2010 shareholder communication, promising to keep at least $10 billion in liquid assets (though typically closer to $20 billion). This isn’t undue prudence; it’s planned readiness for the next unavoidable market scare.

Buffett once more had unprecedented cash reserves in the mid-2020s, when markets appeared unstable, prepared to seize possibilities.

To summarize, Buffett’s attitude stresses the significance of remaining logical, appreciating fundamentals, and seeing market slumps as chances rather than misfortunes. It entails being ambitious when others are scared, a tenet that has benefited him greatly over decades of investment.